is inherited money taxable in florida

This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is. Taxing Inheritance as Income in Florida.

Is There A Florida Inheritance Tax St Lucie County Fl Estate Planning Attorneys

The good news is Florida does not have a separate state inheritance tax.

. Is inherited money from Florida taxable. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40. The point to understand is that when it comes to inheritance tax Florida does not have its own additional tax.

Whether an inherited item or property is. An inheritance can be a windfall in many waysthe inheritor not only gets cash or a piece of property but doesnt have to pay income. Federal Estate Tax.

For example if your father leaves you 200000 in life insurance. First the property taxes will go up if you inherited the persons homestead and you have your own homestead. Be sure to file the following.

The estate of a deceased person in Florida could still owe federal inheritance taxes if the value of estate is over the. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. Inheritance Tax in Florida.

Inheritances Arent Taxed as Income. Is inherited money taxable in florida. What are the tax implications of inherited property in Florida.

If the estate reported the income in respect of a decedent on its income tax return you dont need to report it as income on your income tax return. There are exemptions before the 40 rate kicks. There is no inheritance tax or estate tax in Florida.

The State of Florida does not have an inheritance tax or an estate tax. This means if your mom leaves you 400000 you get 400000 there are no. Even further heirs and beneficiaries in Florida do not pay income tax on any.

Is the Inheritance I Received Taxable. The only other way that inheritance can result in taxation in Florida is when it counts as income. However this tax only applies to large estates in excess of 117.

The Florida Income and Inheritance Taxes Amendment also known as Amendment 1 was a legislatively referred constitutional amendment in Florida which was approved on the ballot on. There is no federal inheritance tax but there is a federal estate tax. Its against the Florida constitution to assess taxes on inheritance no matter how much its worth.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no. Mom dies in 2012 when the house was worth 100000 and you inherit the house. If they are paid in installments over several years the part of each installment that constitutes interest rather than principal is taxable.

Yet some estates may have to pay a federal estate tax.

Do I Have To Pay Taxes On An Inherited Annuity Mastry Law Estate Planning

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

Trusts And Probate Faqs Bogin Munns Munns

Desantis Delivers An Estate Tax Savings Gift For Floridians

Can You Inherit Debt From Your Parents Or Spouse Debt Org

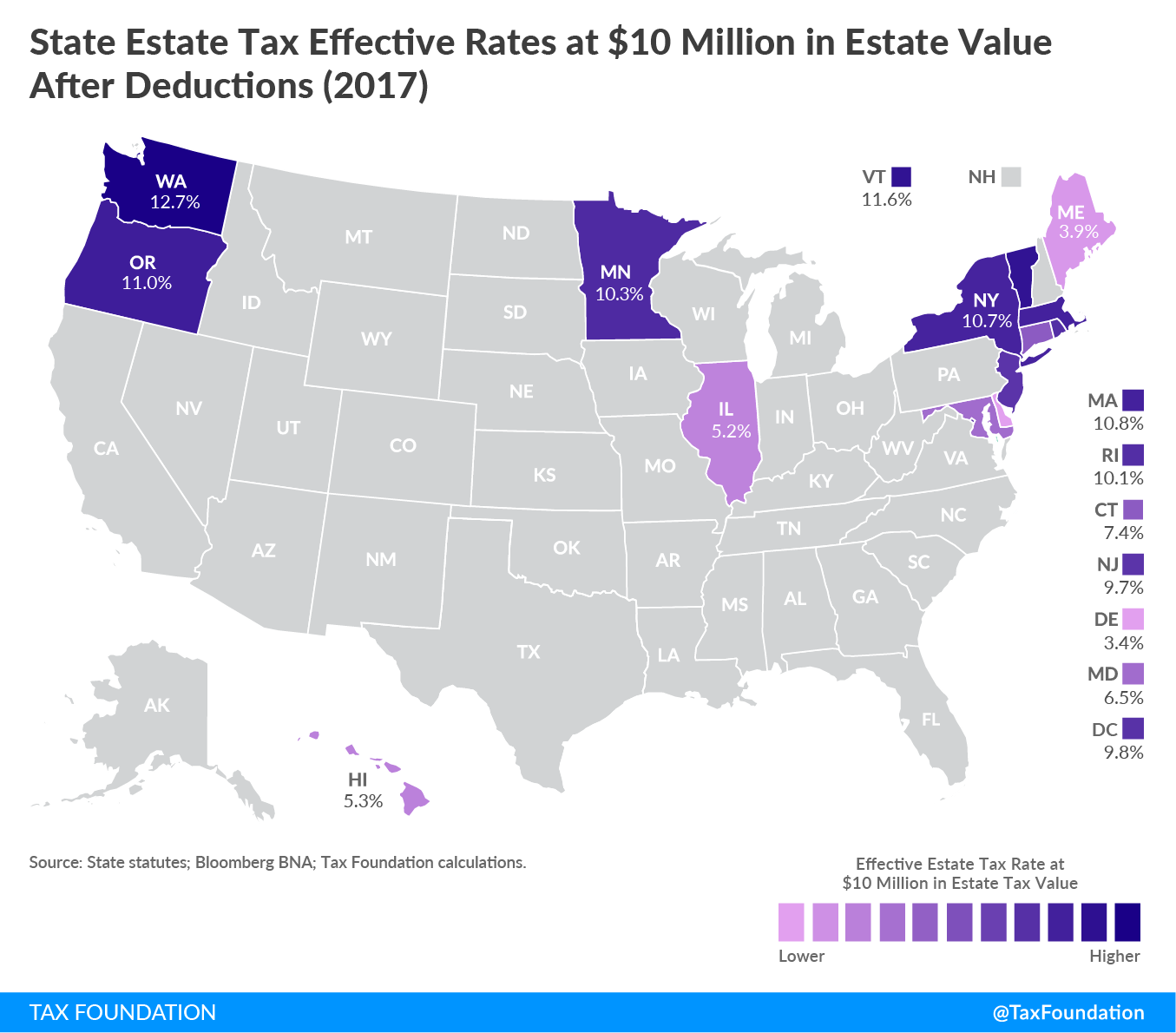

State Estate And Inheritance Taxes Itep

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

Estate Planning Strategies To Help Heirs Enjoy More Of Their Inheritance As Exemption Amounts May Shrink South Florida Business Journal

State Death Tax Hikes Loom Where Not To Die In 2021

/images/2021/08/10/happy-woman-doing-taxes.jpg)

How To Avoid Inheritance Tax 8 Different Strategies Financebuzz

9 States With No Income Tax Bankrate

Is There An Inheritance Tax In Florida And Will You Have To Pay The Handy Tax Guy

Legal Advice To Avoid Taxes On Inheritance

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com

Myths And Facts About The Maryland Inheritance Tax Annapolis Md Estate Planning Attorneys

The Dreaded New Jersey Inheritance Tax How It Works Who Pays And How To Avoid It Nj Com